You can’t concentrate during the convention. Not seeking medical help but instead attending the convention, it worsens your health condition (incurring a further loss). The RM1,000 paid is non-refundable, gone, kaput, regardless of your attendance. It can make you act foolishly and incur a further loss. Instead of seeking medical help, you attended the convention because you don’t wish to squander the RM1,000 paid. The night before the event, you became ill (cold, cough & fever) and have trouble stepping off the bed. Sunk cost is a past cost (including time wasted or non-cash resources) paid, irrecoverable regardless of any subsequent actions.įor example, you paid RM1,000 for a business convention. The whole thing is pathetic.Actions that create further loss in an attempt to recover losses from an earlier decision Valuewalk, obviously, is trying to feed the vanity of the underperforming middle aged guys with a Scottrade account with shit like this. They cannot live with the idea that someone can spend a lot of time, energy, and effort beating the market and making more money than them, so they nitpick and look for any opportunity to criticize.Įveryone in this sub should read Mallaby's "More Money than God". This sub's Boglehead-crazed "no-one-can-beat-the-market" strong EMH loving index to infinity people are just like the average girlfriend I had so many years ago. I really rammed into her (metaphorically speaking, of course.) I said it was disgraceful, embarrassing, and pathetic. I began yelling at her, screaming at her how she was trying to cover up her own insecurities by bringing other people down. My girlfriend saw her and said, "tsk tsk, that girl's outfit is SO tacky! And really she has no curves at all." One day we were driving down the road and there was a gorgeous tall, thin blonde woman walking her dog. All of this coming from a plump plain-looking girl. In conversations she would go on about how Brittany Spears's nose was too big (this was in the 90s), or Gwen Stefani looked "weird". Her way of coping with being the average girl around a bunch of bombshells was pretty typical: she would always in private pick apart their appearance and find flaws. This was an upper middle class neighborhood outside of America, where the high school cliques and "Mean Girl" culture doesn't really exist. Those girls were never mean to her-they were mostly quite nice, polite people, actually. She also went to a high school that just happened to have a lot of very thin and beautiful girls. She was about as average looking as you can get. She didn't have the prettiest face, but she wasn't hideous either. When I was a teenager, I dated a chubby girl.

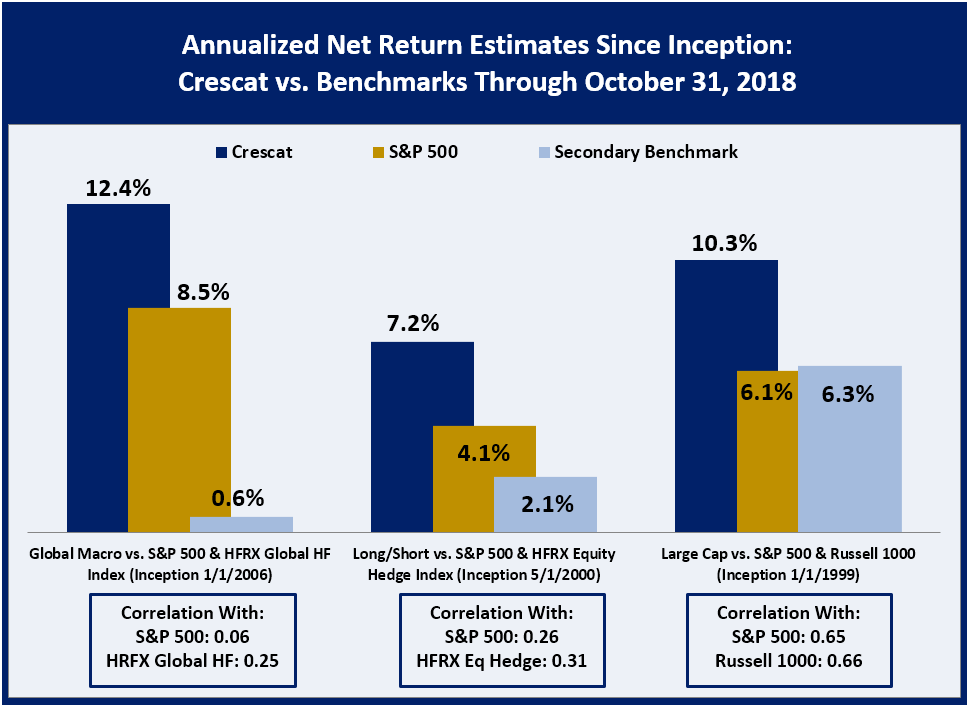

Not sure why hedge funds get so much hate on this sub.

0 kommentar(er)

0 kommentar(er)